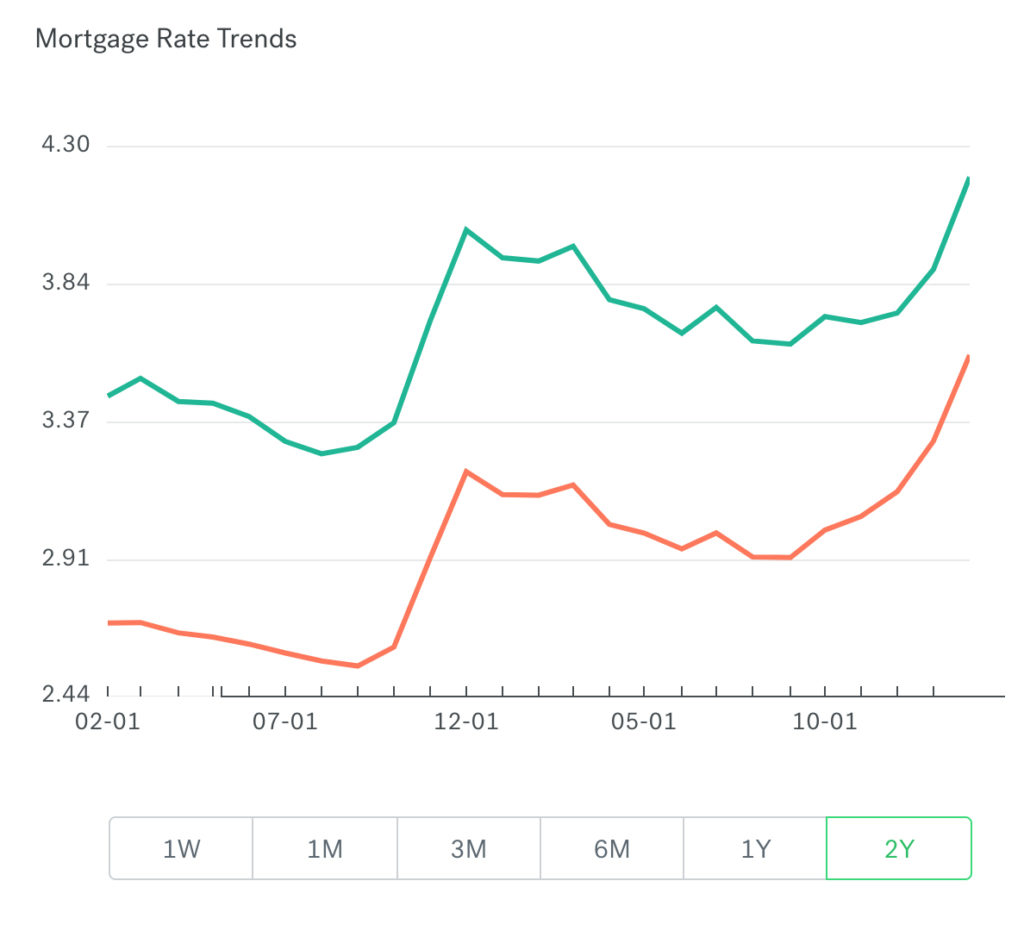

As mortgage rates continue climbing, it might seem like Austin buyers need to rush into securing a home to get a low rate. However, according to Trulia and Zillow, the current Austin interest rates of 4.2 percent for a 30-year fixed mortgage and 3.6 percent for 15-year fixed are still historically low. Meaning buyers can enjoy below-typical percentages without having to make any hasty housing decisions.

Mortgage rate trends for Austin, TX from February 2016 to February 2018, with red line representing 15-year fixed mortgage rates and green line representing 30-year fixed mortgage rates. Photo credit: Trulia.com.

Because Austin homebuyers still have plenty of time to secure minimal mortgage interest rates, it’s important to remember not to rush into a home just to obtain a slightly reduced rate. Make sure to fall in love with a house before signing on the dotted line or you may have to sell in the short term. And starting the buying process over might mean getting a higher mortgage rate than if you had waited to find your ideal home during the first transaction.

Before you make an offer, knowing the purchasing landscape is crucial. These tips will assist you in navigating how increasing mortgage rates affect buyers in Austin.

Affordability May be an Issue

One of the biggest items impacted by changing percentages is affordability. Because current homeowners’ mortgage rates are lower than what they’d receive if they went to buy a different home, they’re not as motivated to sell. This causes buyers to see a reduction in the number of homes available for purchase in their price range. And with fewer homes on the market, buying a home becomes less affordable.

Also, homeowners have a decreased ability to buy a larger home or one in a better location because their mortgages are now more expensive and there’s less available inventory. Plus, according to Austin’s Independence Title, for every 1 percent rate increase, consumers lose 11 percent of their purchasing power. Rising mortgage rates might mean buying an Austin home is a bit less affordable, but the city continues to be an attractive market that’s relatively affordable when compared to other metro areas around the country.

Higher Rates Mean Higher Mortgage Payments

Higher Rates Mean Higher Mortgage Payments

Because interest percentages are greater than before, mortgage payments will be higher, but not by much. The margins monthly payments are going up are steady, but slow, as mortgage rates return to normal. Buying in the short term does mean securing a lower monthly payment, but waiting to find the home that fits your needs and budget doesn’t mean you’re missing out. The sluggish pace actually provides more time to obtain one of these better rates.

You Need to Know Your Mortgage Rate Range

In order to purchase the type of home you want, Austin buyers need to know their mortgage rate range. Discussing present mortgage rates with your lender will help you figure out exactly how far your budget will go in terms of interest rates and what’s truly in your price range. If you can afford up to 5 percent, that gives you wiggle room if rates grow by the time you find a suitable home.

Buying Now is Good Idea, But Not a Necessity

Buying Now is Good Idea, But Not a Necessity

Although it’s valuable to lock in a low percentage, it’s much more important to find a home you love. If that home appears now, considering buying, but feeling pressured to purchase over mortgage interest rates could lead to buyer’s remorse.

Interest rates are likely to increase over the next few years, states the Austin Board of REALTORS (ABOR) February 2017 report; however, it’s still one of the best times for Austinites to purchase a home with the currently low mortgage percentages.

Remember, present rates are still on the historical low side. Even though percentages are increasing, it’s still a great time to purchase a home in the growing, thriving city of Austin.

Are you thinking of buying a house in Austin right now? Let us know what you think about changing mortgage rates and home buying on our Facebook and Twitter pages.